Life Insurance in and around Evansville

Coverage for your loved ones' sake

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

Be There For Your Loved Ones

No one likes to focus on death. But taking the time now to plan a life insurance policy with State Farm is a way to express love to your partner if the worst happens.

Coverage for your loved ones' sake

Now is the right time to think about life insurance

Love Well With Life Insurance

Having the right life insurance coverage can help loss be a bit less debilitating for the people you're closest to and allow time to grieve. It can also help meet important needs like childcare costs, utility bills and future savings.

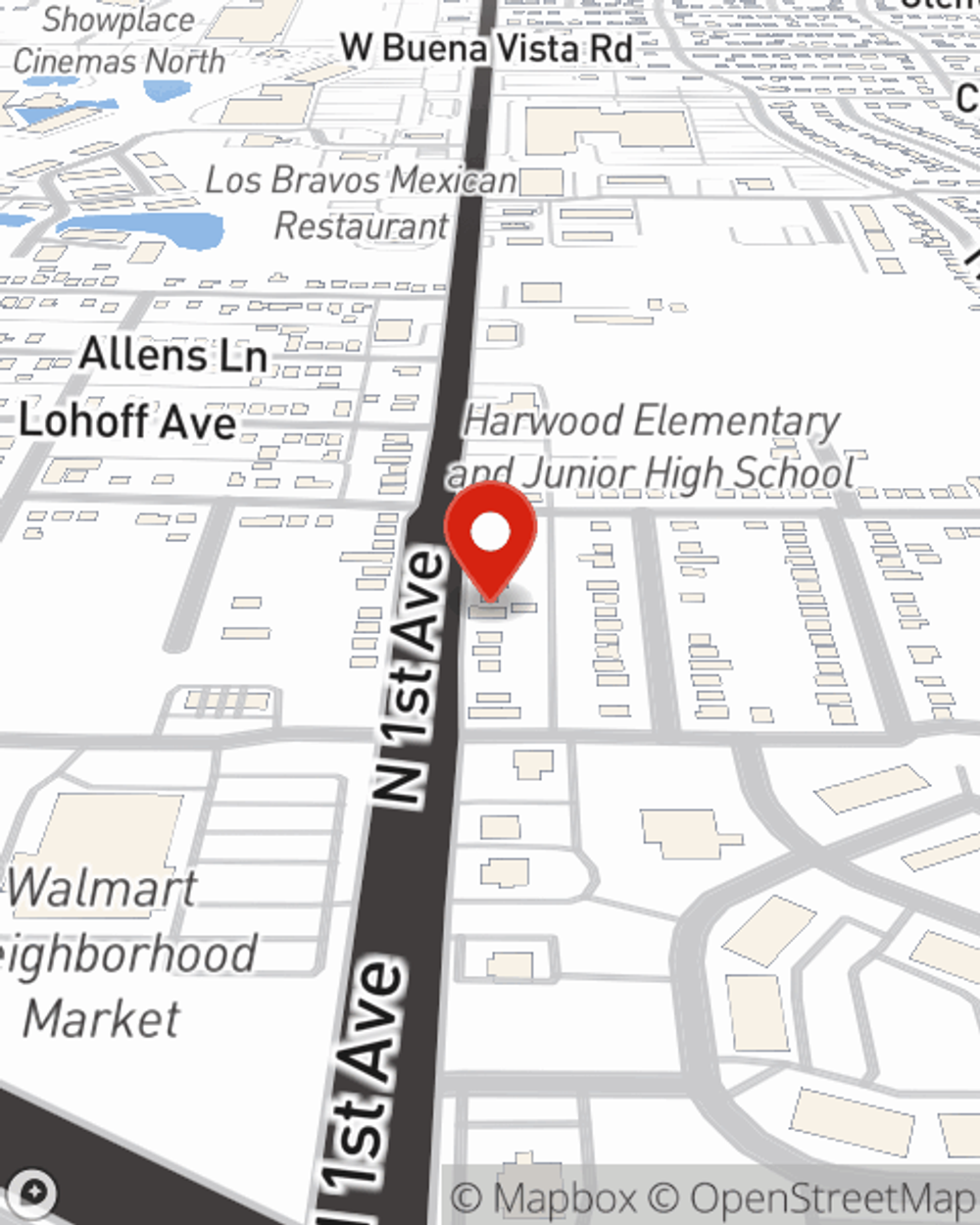

With reliable, caring service, State Farm agent Don O'Bradovich can help you make sure you and your loved ones have coverage if the worst comes to pass. Call or email Don O'Bradovich's office now to learn more about the options that are right for you.

Have More Questions About Life Insurance?

Call Don at (812) 477-9020 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

Don O'Bradovich

State Farm® Insurance AgentSimple Insights®

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.